Thinking about giving back? A Donor Advised Fund might be right for you.

A Donor Advised Fund (DAF) is a simple, flexible, and tax-smart way to support the causes you care about—now and in the future. It allows you to contribute cash or stock, receive an immediate tax deduction, and recommend grants to your favorite charities over time.

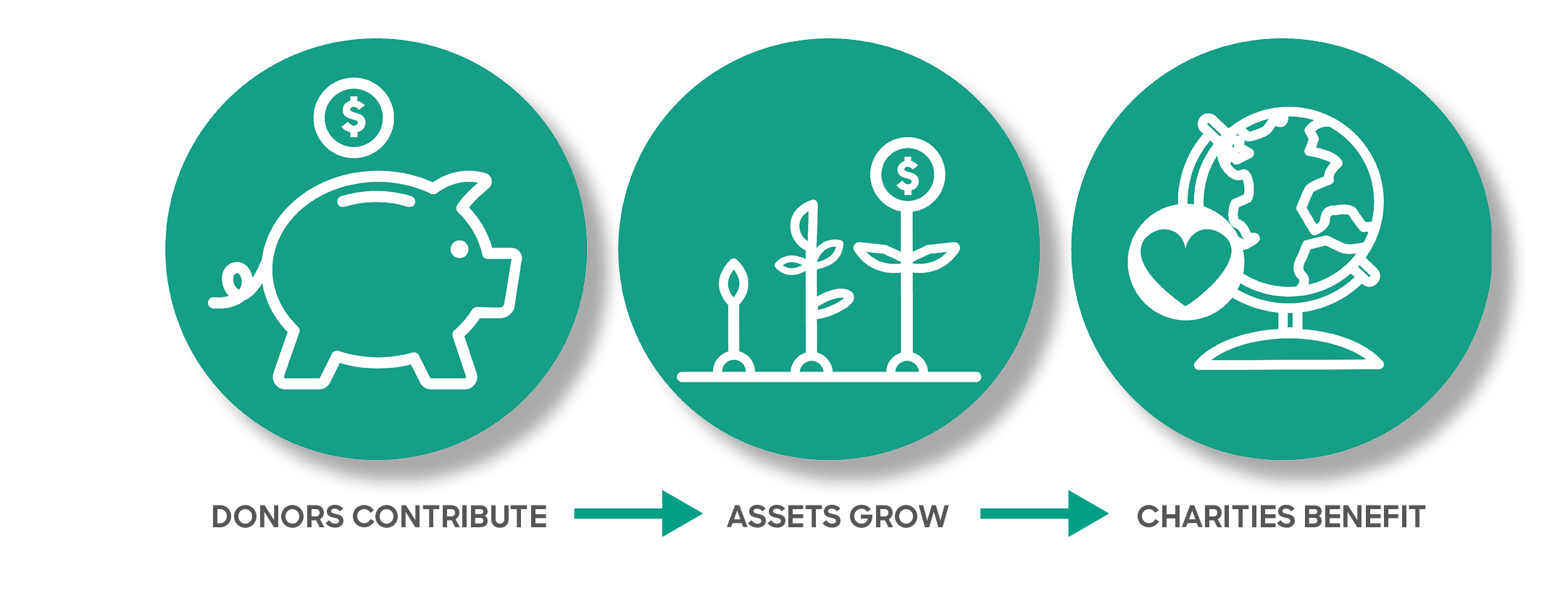

How It Works:

- You make a gift of cash or stock to open a DAF at a sponsoring organization.

- Your gift is invested and can grow tax-free.

- You recommend grants to charities of your choice—whenever you’re ready.

- You can give during your lifetime, and your children can continue your legacy after you’re gone.

Why Choose a DAF?

- Simple: Make one large gift, then support multiple charities over time.

- Flexible: Recommend grants at your convenience—annually or as needs arise.

- Efficient: Enjoy tax advantages and lower costs compared to setting up a private foundation.